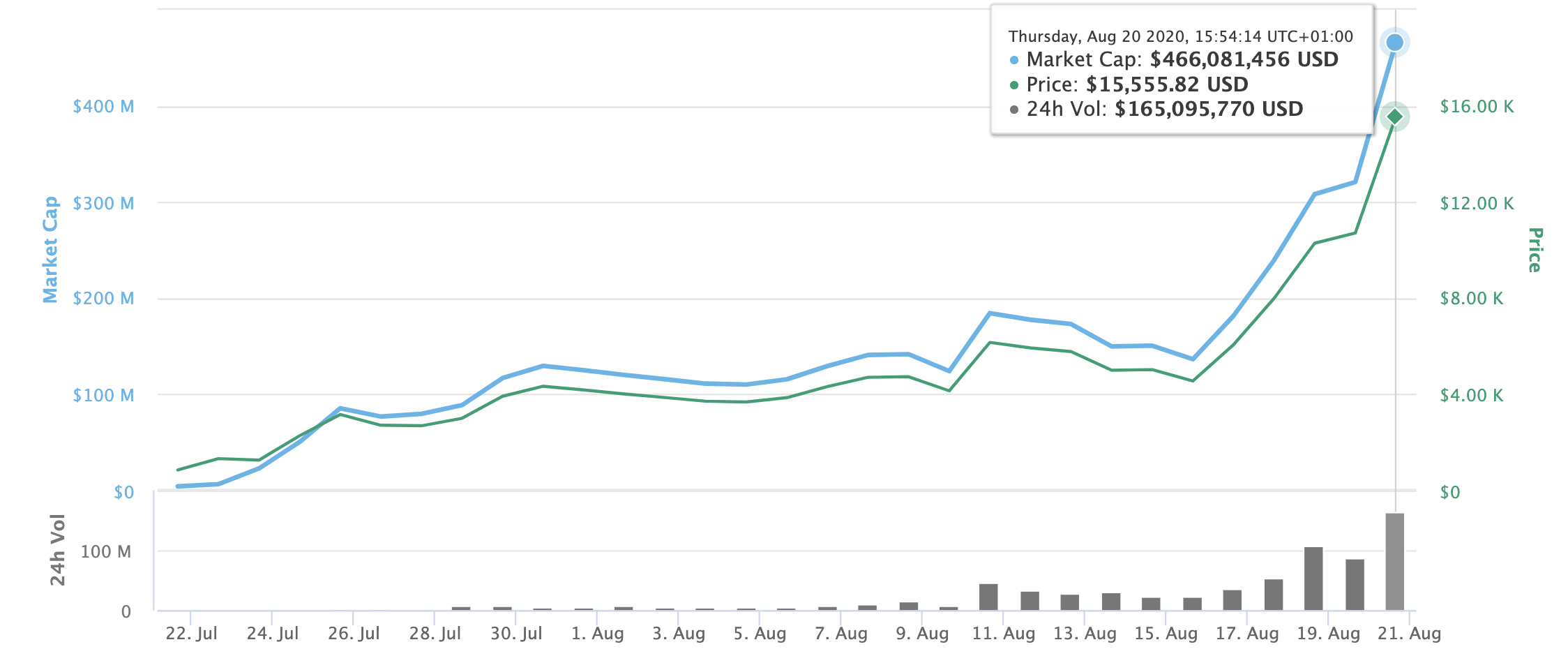

Between May 2021 and June 2022, YFI was on a downtrend, declining to around $4,400 by mid-June 2022. The overall crypto market’s turbulence in 20 didn’t spare the YFI token, either. From that point, YFI experienced a relatively long period of growth, hitting its all-time-high price of $90, 786.89 on May 12, 2021. In September, the YFI token reached its 2020 highest price of over $43,000 as the market reacted positively to the new platform’s innovative business model and the scarce levels of the token’s supply.Īfter the initial enthusiasm had worn off, YFI had a significant downward correction, sliding to approximately $8,500 by early November 2020. During that day, the Yearn Finance price touched its all-time-low price of $31.65, and then set out on a confident growth trend that lasted until mid-September 2020.

On its first trading day on the market (July 18, 2020), the YFI token was valued at around $790. On these DeFi platforms, the token can be used to earn yields in a variety of YFI-based pools. Additionally, several popular DeFi protocols such as SushiSwap and Curve Finance accept YFI deposits on their platforms. The YFI token may also be invested on the platform to earn yields. As such, Yearn is among the very few protocols in the crypto world that pay rewards in exchange for governance voting. YFI holders are rewarded with a proportion of the protocol’s earnings for taking part in the voting process. The standard lockup period for each vote is three days. In YFI’s terminology, staking refers to a temporary lockup of funds on the protocol for governance purposes. Token holders have the right to stake their YFI and participate in the formal voting process on the platform. Yearn’s native cryptocurrency is YFI, an ERC-20 standard token.

It gradually expanded its services, investment options and technical features, introducing V2 of the protocol in January 2021 and V3 in May 2022. Yearn handles the investments by allocating them to a variety of liquidity pools on other DeFi protocols to derive the best possible yields.

Crypto investors may use Yearn Finance to maximize their returns by depositing funds on the platform. Yearn Finance price is updated and available in real-time on, also known as Yearn Finance (YFI), is an Ethereum-based, multi-chain decentralized finance (DeFi) platform that offers automated yield optimization and aggregation services. With all of its protocols operating on the Ethereum blockchain, YFI tokens are ERC-20 based and utilize a Proof-of-Stake consensus mechanism. Yearn.Finance operates on a completely decentralized system, making it possible for the protocol to function effectively without a third party overseeing the operation.The Yearn.Finance cryptocurrency ($YFI) facilitates this process and moves transactions throughout the protocol. The Yearn.Finance protocol creator is also recognized for creating and developing other successful protocols and platforms.

Yfi token price software#

Yearn.Finance was launched in July 2020 by Andre Cronje, an experienced computer scientist and software developer with proficiencies in and related to blockchain science and decentralized architecture. Yearn.Finance runs on the Ethereum blockchain network, so users can utilize ERC-20 tokens to benefit from trading opportunities on the platform. Yearn.Finance is a set of protocols that enable users to optimize earnings on crypto assets through DeFi lending and trading.

0 kommentar(er)

0 kommentar(er)